Insight into Stock Index Futures

by Mark O’Brien, Senior Broker:

Stock Index Particulars:

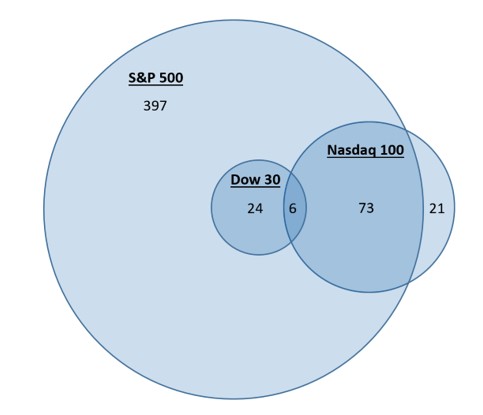

If your preferred futures contracts to trade are stock index futures, check out how many stocks are represented in the Dow Jones, S&P 500 and Nasdaq 100. The Venn diagram below shows how many stocks are part of each index – using the Nasdaq 100 instead of the full Nasdaq. This was located on-line and dated Nov. ’20 which, given how these indices change should be taken as representative.

Note that the Dow 30 is just a subset of the S&P 500. The Nasdaq 100 has 79 stocks that overlap with the S&P 500, so, even though the Nasdaq is characterized as a tech index, the S&P 500 covers it pretty well.

One Specific Company

We don’t incorporate news about individual stocks much, but because Nvidia is the fifth biggest weight in the S&P 500 and the Nasdaq and the company reports earning this afternoon, it’s worthy of this blog, particularly today because the company is reporting earnings this afternoon and a lot is riding on it. Back in May, Nvidia stunned Wall Street when it forecast revenue of about $11B for the fiscal second quarter, which was billions of dollars higher than estimates. It’s now showtime to see if Nvidia can make good on those projections.

Over the past eight quarters, Nvidia’s stock has swung an average of 8.6% post-earnings, so big swings by the stock could influence movement and sentiment surrounding the major stock index futures.

The Fed.

As Federal Reserve officials close in on the end of their tightening campaign, the debate is shifting from how high interest rates need to go to how long they should stay elevated.

Inflation pressures are easing, which could give policymakers room to keep interest rates at or near current levels for the time being.

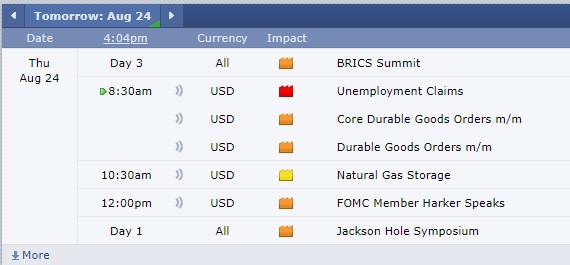

How do Fed Chairman Jerome Powell and his colleagues view their progress against inflation? We’ll find out this Friday when Mr. Powell steps up to a lectern in the Grand Tetons at the annual Jackson Hole Economic Symposium. His speech is the next big chance for clues about whether central bank officials believe they will need to raise interest rates again before inflation is tamed.

Plan your trade and trade your plan.

Keltner Channels, Volume Charts, Algo Signals – Trade Set Up

- Watch the 5 minute video below in which I share a trading set up I like, using volume charts, candle sticks, Keltner Channels and proprietary ALGOs for trading signals.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

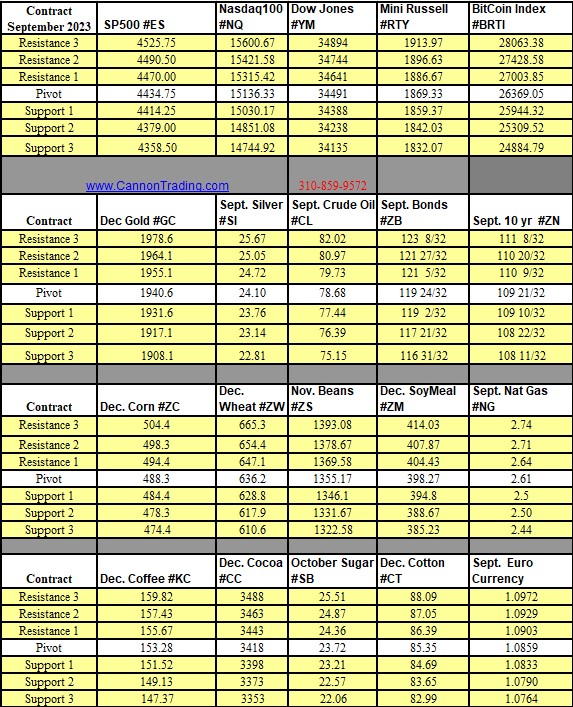

Futures Trading Levels

8-24-2023

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.