FOMC Tomorrow

The following are my PERSONAL suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 3925.00 with a stop at 3919.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 3919.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Keep in mind statement comes out at 1 Pm Central time, the news conference which dissects the language comes out 30 minutes later so the volatility window stretches out.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

A Cannon broker will be able to assist, provide feedback and answer any questions.

Micro E-mini Futures and Options Webinar

Access new markets with the enhanced suite from CME Group

CME Group invites you to attend an online event focusing on the Micro E-mini futures and options suite on Wednesday, March 22.

Join us as Craig Bewick, Senior Director of Client Development & Sales, and Paul Woolman, Global Head of Equity Products, discuss the trading performance and rise in liquidity of Micro E-mini Equity futures and options. In addition, they will cover recent enhancements to the suite, including the introduction of Micro E-mini S&P MidCap 400 and SmallCap 600 futures as well as the Micro E-mini Monday-Thursday Weekly options.

Follow the link below to register for this online event. Further instructions will be provided following registration.

DATE:

March 22, 2023

TIME:

8:00 a.m. – 9:00 a.m. (CT)

1:00 p.m. – 2:00 p.m. (GMT)

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

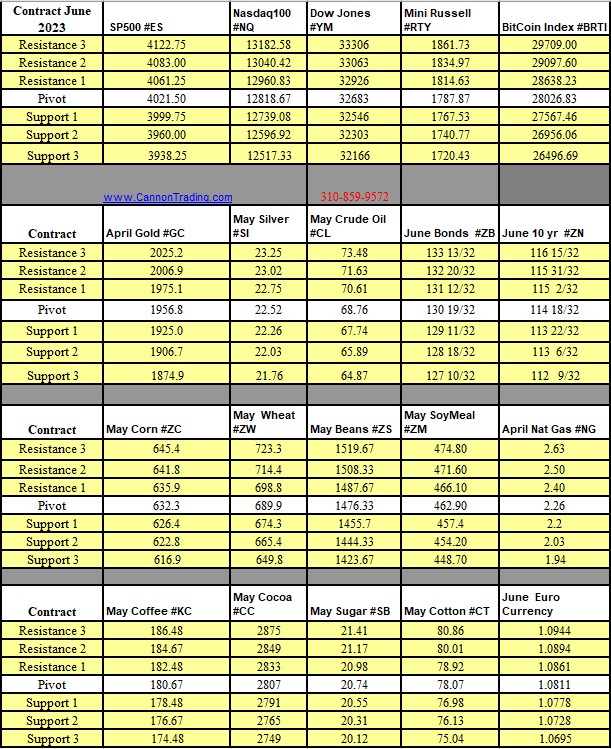

Futures Trading Levels

3-22-2023

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.