Ahead of NFP this TOMORROW, the below is provided by our friends over at NewSquawk.com

PREVIEW: US nonfarm payrolls (Feb’23) to be released on Friday March 10th at 13:30GMT/08:30EST

EXPECTATIONS: The consensus looks for 203k nonfarm payrolls to be added to the US economy in February (forecast range: 100-325k), with the pace cooling from the 517k added in January. If the consensus is realized, it would be lower than the pace of the 3-, 6- and 12-month averages, at 356k, 349k and 414k respectively. The unemployment rate is expected to be unchanged at 3.4% (range: 3.3-3.5%); the Fed projects that the jobless rate will peak at 4.6% in 2023, although the central bank will update its economic projections at the March 21-22nd confab.

The CME FedWatch tool is a free online resource provided by the Chicago Mercantile Exchange (CME) that provides information about the market’s expectations for changes to U.S. Federal Reserve policy. Here’s how to use it:

1. Go to the CME FedWatch tool website: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

2. Scroll down to the “Countdown to FOMC” section.

3. Review the table to see the probability of an interest rate change or no change at the next Federal Open Market Committee (FOMC) meeting, as well as the probability of future rate changes.

4. You can also view the implied yield of the Fed Funds futures contract for each FOMC meeting. This represents the market’s expectation of the federal funds rate at the specified date.

5. To view more detailed information, click on the “View Tool” button at the top of the page. This will take you to a page with additional charts and data about the market’s expectations for the federal funds rate.

6. The Fed DOTPLOT is found on the left-hand margin of the tool.

Note that the CME FedWatch tool is not a crystal ball and cannot predict the future with certainty. It is simply a reflection of the market’s current expectations and can be affected by changes in economic conditions or other factors.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

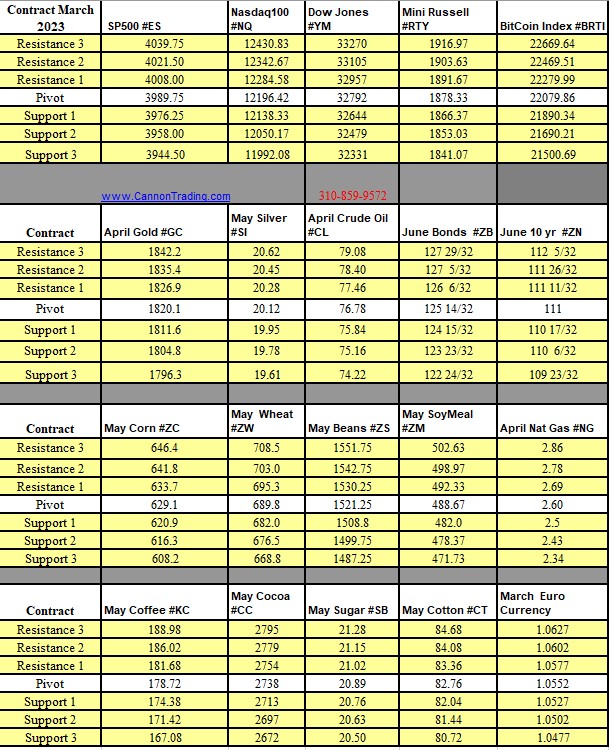

Futures Trading Levels

3-10-2023

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.