Find out more about commodity brokers at E-futures.com here

Commodity trading has gained immense popularity among investors seeking diversified portfolios and exposure to the global market. To execute successful commodity trades, it is crucial to partner with a reliable and efficient commodity broker. In this article, we will delve into the world of commodity brokers and highlight the reasons why E-futures.com stands out as an exceptional platform for commodity trading.

Understanding Commodity Brokers: Commodity brokers act as intermediaries between traders and the commodity exchanges. They facilitate the buying and selling of commodities such as precious metals, energy products, agricultural goods, and more. These brokers provide traders with access to various markets, execute trades, offer research and analysis, and deliver valuable insights to assist traders in making informed decisions.

E-futures.com: A Trusted Platform for Commodity Trading: E-futures.com has established itself as a leading online brokerage platform, providing traders with a comprehensive suite of tools and services to engage in commodity trading. Let’s explore the key reasons why E-futures.com is considered one of the best commodity brokers in the industry:

- Extensive Market Access: E-futures.com offers a wide range of markets for traders to choose from, including commodities like crude oil, gold, natural gas, corn, soybeans, and many more. This vast array of markets enables traders to diversify their portfolios and capitalize on various opportunities.

- Advanced Trading Platforms: E-futures.com provides traders with advanced trading platforms that are intuitive, user-friendly, and equipped with powerful features. These platforms allow traders to execute trades efficiently, access real-time market data, monitor positions, and employ various technical analysis tools to enhance their decision-making process.

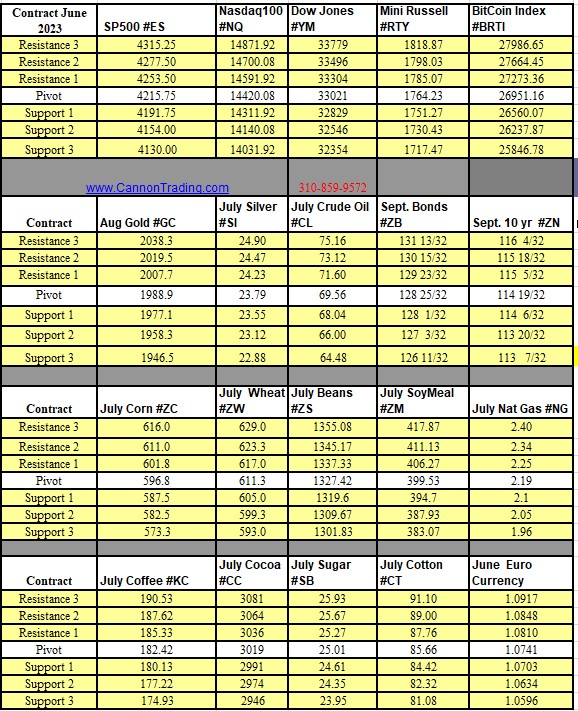

- Robust Research and Analysis: E-futures.com offers comprehensive research and analysis tools to empower traders with valuable insights. The platform provides market reports, charts, historical data, and other analytical resources, helping traders stay updated on market trends and make informed trading decisions.

- Competitive Pricing and Execution: E-futures.com ensures competitive pricing and efficient trade execution. The platform offers transparent commission structures, enabling traders to optimize their trading costs. Moreover, E-futures.com leverages cutting-edge technology to ensure fast and reliable order execution, minimizing slippage and latency issues.

- Risk Management Tools: Managing risk is crucial in commodity trading, and E-futures.com recognizes this importance. The platform provides risk management tools, including stop-loss orders and limit orders, enabling traders to mitigate potential losses and protect their investments.

- Educational Resources and Support: E-futures.com is committed to empowering traders with knowledge and skills. The platform offers educational resources, webinars, tutorials, and personalized support to assist traders at all levels of experience. Whether you are a beginner or an experienced trader, E-futures.com provides the necessary resources to enhance your trading journey.

- Regulatory Compliance and Security: E-futures.com adheres to strict regulatory standards to ensure the safety and security of traders’ funds and personal information. The platform employs robust security measures and encryption protocols to protect data and offers segregated accounts to safeguard client funds.

When it comes to commodity trading, partnering with a reputable commodity broker like E-futures.com can make a significant difference. With extensive market access, advanced trading platforms, comprehensive research tools, competitive pricing, and exceptional customer support, E-futures.com stands out as one of the best commodity brokers in the industry. Whether you are a seasoned trader or just starting, E-futures.com offers the necessary tools and resources to enhance your trading experience and help you achieve your financial goals.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey at E-futures.com today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.