Live Cattle All Time Highs

By Mark O’Brien, Senior Broker

General:

We’re in the midst of a relatively quiet calendar week for economic reports with the highlight coming Friday with the latest USDA crop production and world supply & demand report (11:00 A.M. Central Time release).

Livestock:

Cattle futures prices closed lower – down $2.12 to $173.37 per hundredweight (cwt), basis August – for the first time in ten straight trading sessions going back to May 24th, but not before trading up ±$2.50/cwt to new all-time highs above $178.00/cwt. This caps off a month-long price increase of almost $19.00/cwt – a $7,600 per contract move – starting the first week of May. This year’s U.S. domestic cattle herd is at its lowest headcount in eight years and poor pasture conditions in major feeding ground states (Texas, Oklahoma, Kansas and Nebraska) due to drought conditions there threaten to keep prices elevated for the near term. On the demand side, albeit ±8% off its 30-year high point between Jan. and April of last year, wholesale beef demand remains strong. As can be the price catalyst for so many agricultural commodities, mother nature will play a key roll in influencing cattle prices as we enter summer. Much needed rain over important cattle pasturage acres can improve feed crop conditions as well as yield, thus bring down prices of a component of overall cattle prices. Prolonged drought conditions point to new record high beef prices this summer.

Monthly Chart of Live Cattle Below

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

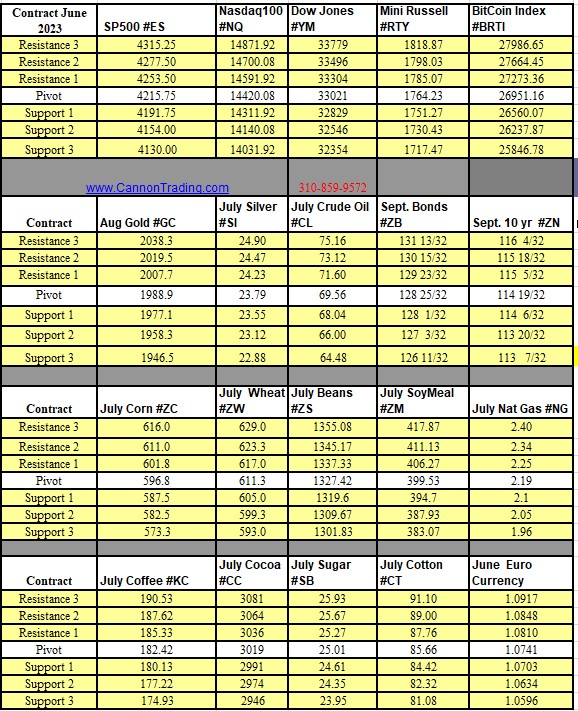

Futures Trading Levels

6-07-2023

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.