Read more about using I-Systems through E-Futures here.

In the ever-evolving world of financial markets, technological advancements have played a pivotal role in reshaping the landscape of trading. Among these advancements, automated trading systems have emerged as a game-changer. E-Futures.com, a prominent player in the field of futures trading, offers a cutting-edge suite of automated trading systems called I-Systems. These systems leverage AI technologies and algorithmic trading strategies to provide traders with a competitive edge in the complex world of futures trading.

This article delves into the world of I-Systems offered by E-Futures.com, exploring their capabilities, the variety of futures products they trade, and the posted results that showcase their effectiveness in today’s highly competitive financial markets.

I-Systems: The Future of Futures Trading

E-Futures.com’s I-Systems are automated futures trading systems that have gained recognition for their advanced features and powerful capabilities. These systems are designed to facilitate trading in futures markets by utilizing artificial intelligence (AI) and algorithmic trading strategies. Here’s a closer look at what makes I-Systems a groundbreaking solution in the world of futures trading:

- AI-Powered Trading: I-Systems incorporate AI technologies to make trading decisions. Machine learning algorithms analyze vast amounts of historical data to identify patterns, trends, and potential trading opportunities. This intelligent approach allows I-Systems to adapt to changing market conditions and make data-driven decisions, often beyond the capabilities of human traders.

- Risk Management: Automated futures trading systems are equipped with sophisticated risk management tools. They can set predefined stop-loss levels, profit targets, and position sizing parameters, ensuring that traders can manage their risk effectively. This is crucial in futures trading, where leverage can amplify both gains and losses.

- Diversification: I-Systems offer the ability to trade a wide variety of futures products. Traders can diversify their portfolios by trading different contracts, such as equity index futures, commodity futures, interest rate futures, and more. This diversification spreads risk and potentially increases profitability.

- Round-the-Clock Trading: These systems operate 24/7, allowing traders to take advantage of global market opportunities. The futures market never sleeps, and I-Systems ensure that traders don’t miss out on lucrative trades, even when they are away from their screens.

- Emotion-Free Trading: One of the most significant advantages of automated trading is the elimination of emotional biases. I-Systems execute trades based on pre-defined rules and algorithms, eliminating fear and greed from the decision-making process. This can lead to more consistent and disciplined trading.

Variety of Futures Products Traded

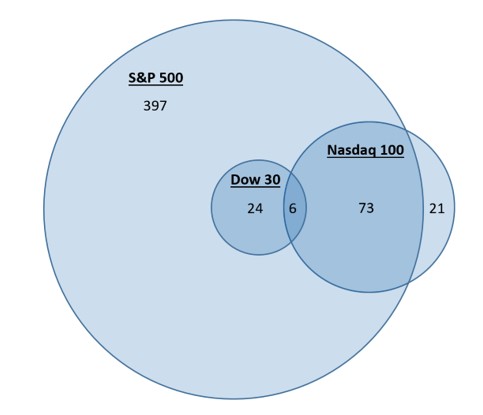

E-Futures.com’s I-Systems provide traders with access to an extensive range of futures products. This diversity enables traders to build diversified portfolios and capture opportunities in various asset classes. Let’s explore some of the key futures products that I-Systems can trade:

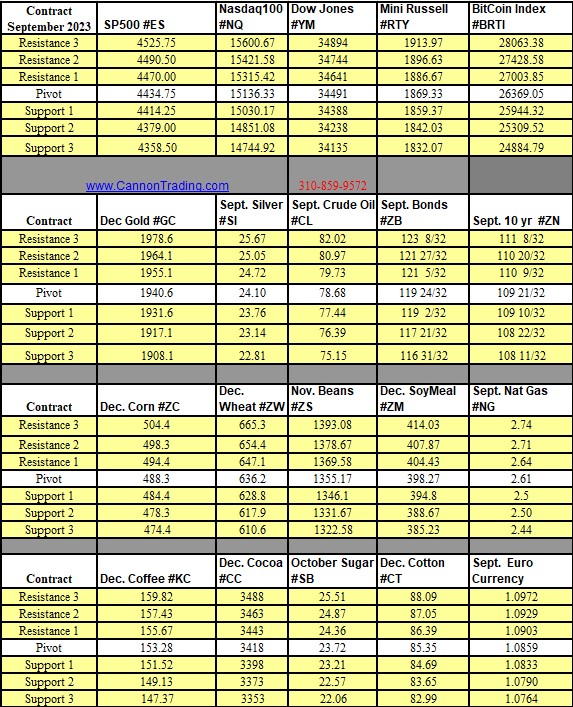

- Equity Index Futures: I-Systems can trade futures contracts on major stock indices like the S&P 500, Nasdaq 100, Dow Jones Industrial Average, and more. These contracts allow traders to speculate on the performance of entire stock markets.

- Commodity Futures: The systems can also trade a wide array of commodity futures, including crude oil, gold, silver, agricultural commodities like corn and soybeans, and industrial metals like copper. Commodity futures provide exposure to the fluctuations in raw material prices.

- Interest Rate Futures: I-Systems are equipped to trade interest rate futures, which are based on government bond yields. These contracts allow traders to speculate on changes in interest rates, making them valuable tools for risk management and hedging.

- Currency Futures: Traders can access currency futures through I-Systems, which provide exposure to foreign exchange markets. These contracts are useful for currency speculation and managing currency risk in international portfolios.

- Energy Futures: Futures contracts on energy commodities like natural gas and heating oil are also part of the product range. These contracts are influenced by supply and demand dynamics in the energy sector.

- Agricultural Futures: I-Systems enable trading in agricultural futures, covering a wide range of crops such as wheat, soybeans, cotton, and more. These contracts are influenced by factors like weather conditions and global demand for food.

- Metal Futures: Traders can explore the world of metal futures, including contracts on precious metals like gold and silver, as well as base metals like copper and aluminum.

- Livestock Futures: Livestock futures contracts, such as those on cattle and hogs, are also available. These contracts are influenced by factors like livestock supply and consumer demand for meat products.

The Variety of futures products that I-Systems can trade ensures that traders have ample opportunities to diversify their portfolios and participate in markets that align with their strategies and risk profiles.

Posted Results: Demonstrating the Power of I-Systems

One of the most compelling aspects of E-Futures.com’s I-Systems is the transparency in sharing their performance results. These results provide traders with valuable insights into the effectiveness of the automated trading systems. It’s important to note that past performance is not indicative of future results, and trading always carries inherent risks. Nonetheless, understanding the historical performance of I-Systems can help traders make informed decisions. Below are some key points related to the posted results of I-Systems:

- Performance Metrics: E-Futures.com provides detailed performance metrics for each I-System. These metrics typically include annual returns, maximum drawdown (the largest peak-to-trough decline), and the average annualized return over time.

- Backtesting: I-Systems often undergo rigorous backtesting, which involves running the trading algorithm on historical data to assess its performance. Backtesting helps identify potential strengths and weaknesses of the system.

- Real-Time Results: In addition to historical data, real-time performance results are also provided. This allows traders to see how the system is currently performing in live market conditions.

- Risk Analysis: I-Systems often include risk analysis reports that highlight key risk factors, including the risk of ruin (the probability of losing a certain percentage of the trading capital) and the risk-adjusted return.

- Simulated vs. Live Results: Some I-Systems may have simulated results based on historical data and actual live trading results. This comparison helps traders understand how the system performs in real-market conditions.

- Strategy Descriptions: E-Futures.com typically provides detailed descriptions of the strategies employed by each I-System. This transparency allows traders to understand the underlying logic of the trading system.

- Customization: Traders can often customize I-Systems to align with their risk tolerance and trading objectives. This can impact the performance results, making them more tailored to individual preferences.

It’s important for traders to thoroughly review the posted results and conduct due diligence before deploying any I-System. Additionally, risk management remains a critical aspect of successful trading, and traders should be prepared for both profitable and losing periods.

E-Futures.com’s I-Systems represent a significant advancement in the world of futures trading. These automated futures trading systems leverage AI technologies and algorithmic strategies to provide traders with powerful tools for navigating the complex and fast-paced futures markets. With the ability to trade a wide variety of futures products and a commitment to transparency in posting results, I-Systems have become a valuable resource for traders seeking to gain a competitive edge.

However, it’s essential for traders to approach automated trading with caution, as it carries inherent risks. Understanding the strategies, risks, and historical performance of I-Systems is crucial before integrating them into a trading portfolio. Ultimately, successful trading requires a combination of advanced technology, sound strategy, and disciplined risk management. E-Futures.com’s I-Systems offer a pathway to explore these possibilities and adapt to the dynamic world of futures trading.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey at E-Futures.com today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.